Understanding the Importance of Secure Payment Online

In an ever-evolving digital landscape, secure payment online is not merely an option but a necessity. With the increasing number of transactions conducted over the Internet, ensuring that your financial information remains protected has become paramount. A secure payment online system provides robust encryption and authentication processes, which help in safeguarding sensitive data against potential breaches. Imagine making an online purchase for your favorite gadget; knowing that your credit card information is being transmitted securely allows for a stress-free shopping experience. Be it purchasing a gift or paying for your utilities, the assurance of security fosters trust between the consumer and the vendor. To ensure that you are always protected, choosing platforms that prioritize secure payment online, such as secure payment online, is essential.

The Role of Global Payment Network in Secure Transactions

The concept of a global payment network plays a crucial role in facilitating secure payment online. This network connects various payment processors, banks, and financial institutions across the world, allowing for instantaneous transactions while providing fraud protection. For instance, when a consumer makes an international purchase, the global payment network ensures that the payment is verified and that the buyer’s data is encrypted throughout the process. This ensures not only the speed of the transaction but also instills confidence in the user, knowing that their information is shielded from unauthorized access. The efficiency of a global payment network has transformed how businesses operate, enabling them to securely accept payments from customers anywhere in the world, thus expanding their reach and enhancing customer satisfaction.

Ensuring Payment Security in Today’s Environment

Payment security has become an increasing concern for consumers and businesses alike. As cyber threats grow more sophisticated, implementing measures for payment security is critical. This includes utilizing technologies like secure socket layer (SSL) certificates that encrypt the data shared between the user’s browser and the server to prevent interception. It is also vital for businesses to employ anti-fraud systems to detect and block suspicious activities proactively. For instance, a retailer might implement two-factor authentication for transactions over a certain amount, adding an extra layer of security. With more individuals opting for online transactions due to convenience, ensuring stringent payment security not only protects customers’ financial data but also cultivates loyalty and confidence in the brand.

Conclusion: Embracing Secure Payment Solutions

In conclusion, the significance of secure payment online cannot be overstated in today’s digital economy. Both the global payment network and payment security play critical roles in ensuring that online transactions are conducted safely and efficiently. When considering options to enhance your eCommerce transactions, it’s crucial to invest in reputable solutions that prioritize these aspects. A recommended brand in this space is FlyLink, renowned for its supply advantages and commitment to providing a secure transaction environment. Trusting professionals like FlyLink can ensure that your online experiences are not only seamless but also safe.

Expanding on the Importance of Secure Payment Online

In an era where digital commerce dominates, secure payment online systems are vital for personal and financial security. The necessity for secure payment digital infrastructures is no longer optional, as incidents of fraud and cyberattacks continue to rise consistently. People are now more aware of the potential risks associated with online transactions, making it crucial for businesses to implement comprehensive security measures. Such measures include end-to-end encryption, which scrambles the data so only authorized parties can read it, bolstering consumer confidence. Furthermore, a secure payment online environment empowers customers to explore new digital shopping opportunities, know their transactions are protected, and enjoy a seamless checkout experience. The peace of mind sourced from adopting secure payment platforms consequently enhances the overall consumer experience and drives repeat business. Thus, ensuring a secure payment online system becomes not just a technical necessity but an essential part of business strategy and consumer relations.

Delving Deeper into Global Payment Network Dynamics

The impact of a global payment network on the efficiency and safety of transactions cannot be understated. This network is responsible for integrating various local payment systems, ensuring a unified and safe payment experience worldwide. For example, a customer in Europe wanting to shop at an Asian online store benefits from the global payment network, which simplifies the payment process and reduces exchange fees, all while minimizing risk. This comprehensive approach creates an avenue where businesses can operate at a global scale, reaching customers from different cultures and financial backgrounds without compromising on security. The intricacies of a global payment network also allow for improved reporting and tracking, enabling businesses to monitor transactions in real-time, thus swiftly addressing any irregularities. Over time, this facilitates the development of trust between consumers and their selected platforms, paving the way for enduring customer relationships and ongoing loyalty.

Enhancing Awareness on Payment Security Strategies

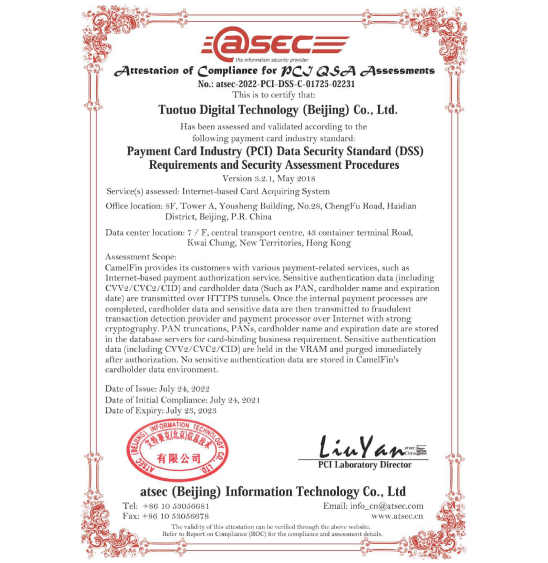

As mentioned earlier, payment security isn’t just a one-time setup but an ongoing concern that requires vigilance from consumers and businesses alike. The digital landscape is rife with potential vulnerabilities, and thus, leveraging modern technologies is imperative. For instance, the adoption of AI-driven fraud detection systems has become essential for banks and online merchants. These technological advancements analyze unusual patterns in transaction behavior and alert the relevant parties, drastically reducing instances of fraud. Regular training of staff in cybersecurity best practices and raising awareness among customers about phishing scams are additional layers of defense. Companies must also comply with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) to ensure they are guarding customer data according to the latest standards. This unified approach to payment security not only preserves client information but also reinforces the company’s reputation, driving growth through trust and reliability in the eCommerce sector.